Overview

NACHA (National Automated Clearing House Association) payments offer a very low-cost, effective solution to receiving Member payments electronically. Office now has the capabilities of accepting ACH payments directly from your Club’s Members, without the need for an intermediary processor, such as ETS, or Open Edge. Use Case In addition to (or in lieu of) accepting Member Credit Card Payments, which oftentimes have high processing fees that impact the bottom line, Management wanted to provide Members with another option to pay their monthly statement electronically, via ACH. With significantly lower fees than credit card processors charge, Clubs are now able to utilize their primary bank for processing ACH’s directly, and provide Members with this additional payment convenience. |

Content

NACHA Setup

To ensure ACH is set up and working properly, there are four main areas that need to be addressed within Office, and one that needs to be addressed directly with the Bank your Club chooses for processing.

Cash Receipt Type - Bank ACH

Member - Bank Account(s)

General Ledger - Bank Account(s)

Member Payments - ACH File Generation

Upload ACH File to Primary Bank (contact your Banking institution for instructions)

Cash Receipt Type - Bank ACH

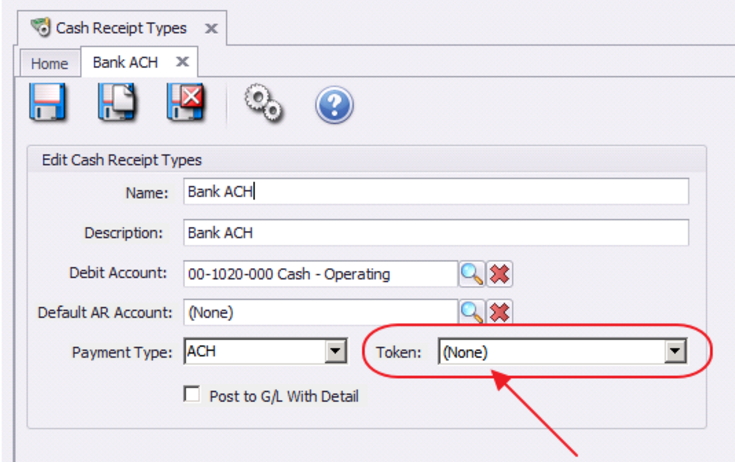

Configuration of the Bank ACH Cash Receipt Type is the first and most essential step to processing NACHA payments. Specifically, the club must ensure the Bank ACH Cash Receipt Type is NOT linked to a Merchant Processing Token. Please follow the below instructions to properly configure the Bank ACH Cash Receipt Type. If the club is currently accepting ACH payments through one of our integrated third party processors, please see the Switching from Integrated ACH Processor to NACHA Payments section of this document for more information on switching to NACHA payments.

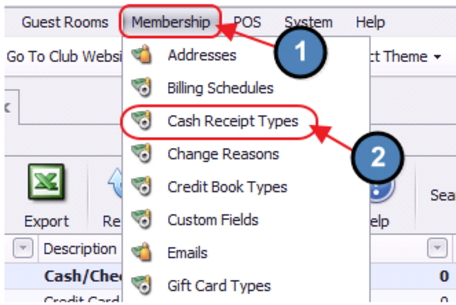

To access Cash Receipt Types

- Select Membership across the top toolbar

- Choose Cash Receipt Types.

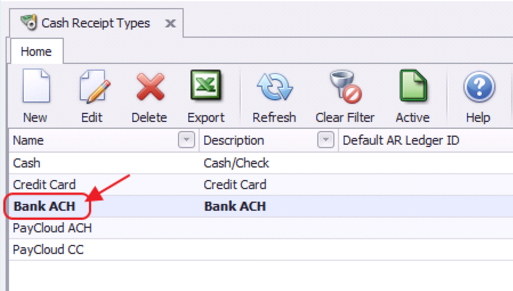

Double-click on the Bank ACH Cash Receipt Type.

Ensure the Token field is set to NONE.

Member - Bank Account(s)

To effectively receive an ACH payment from a Member, the Member’s profile must first contain the appropriate banking information.

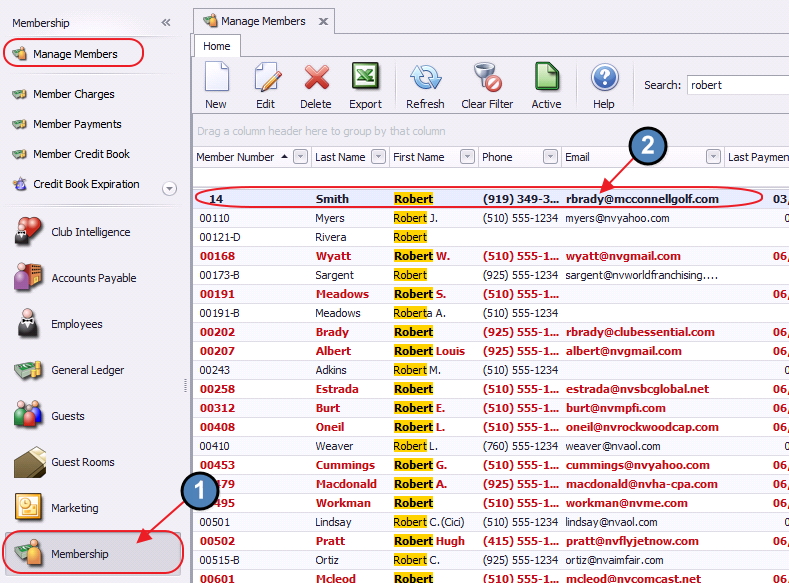

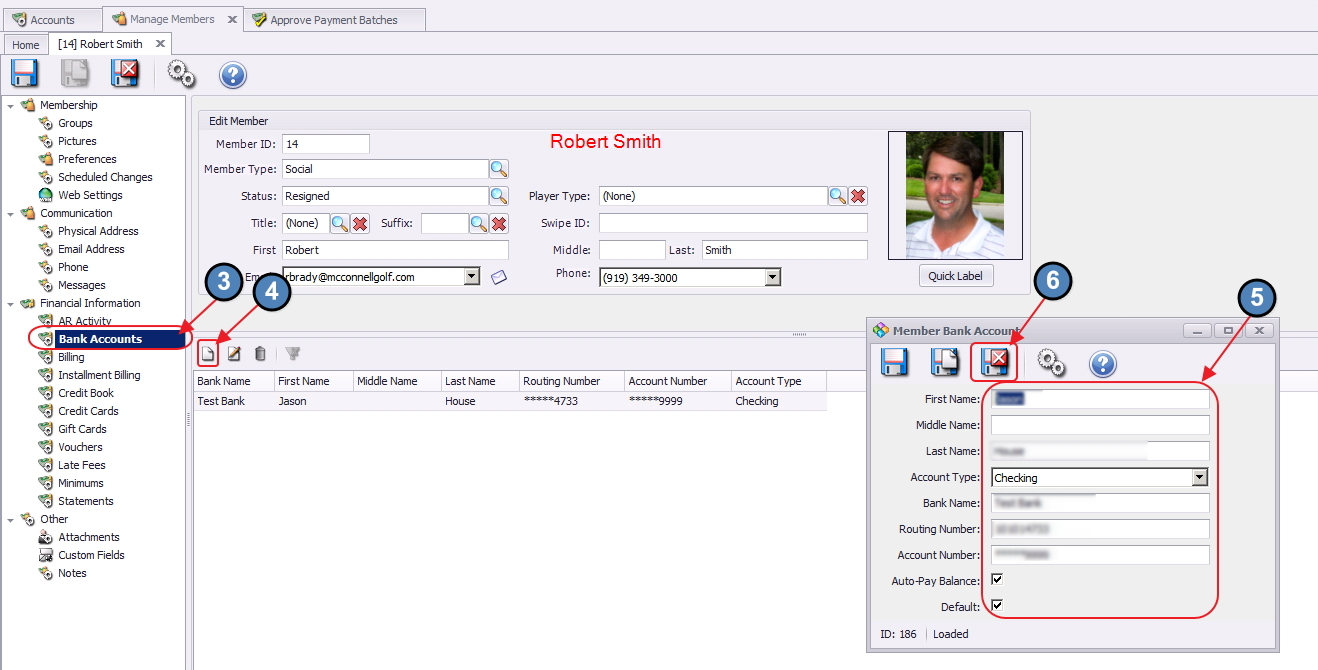

- Within the Membership Module, Manage Members section

- Select a Member

- navigate to the Bank Accounts tab within the Financial Information section of the Member’s profile.

- Click New to add an account

- Complete the tab for the Member’s account they wish to use for ACH payment purposes

- Click Save and Close.

The Member must have banking information set up to make an ACH payment.

General Ledger - Bank Account(s)

In addition to having a Member’s banking information, the Club’s Cash Account that will be receiving the payments from the Members must also be set up properly.

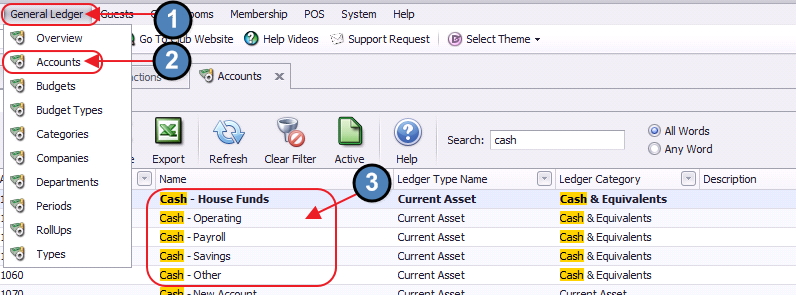

- Within the General Ledger top menu

- Select Accounts

- Double-click on the appropriate cash account that will be receiving the ACH payment.

- Navigate to the Banking tab

- Populate the Bank Name

- Populate Routing Number fields.

These fields must be populated to issue the proper ACH file.

Member Payments - NACHA File Generation

Once the proper Member(s) and Club account have been set up properly in the system, proceed to the Payment Wizard to generate the appropriate NACHA file for the bank.

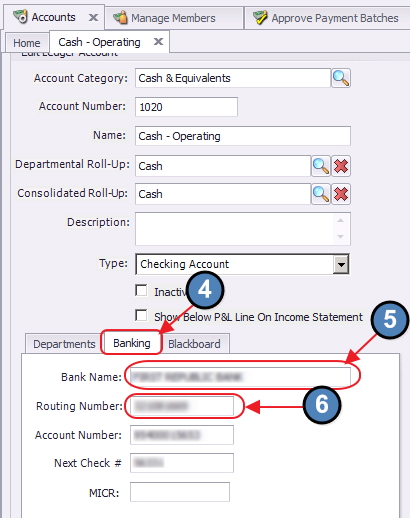

- Navigate to Membership

- Member Payments

- Quick Add to initiate a ACH payment batch.

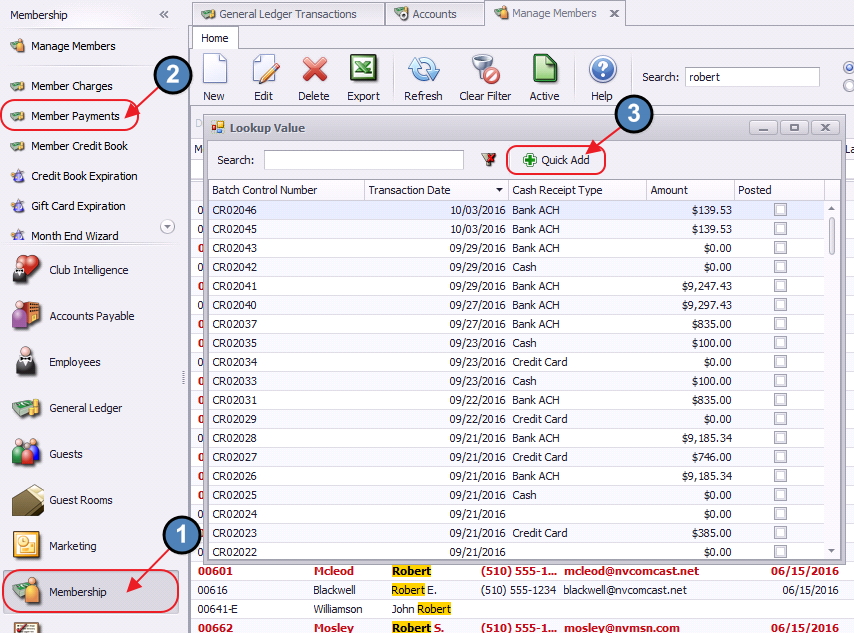

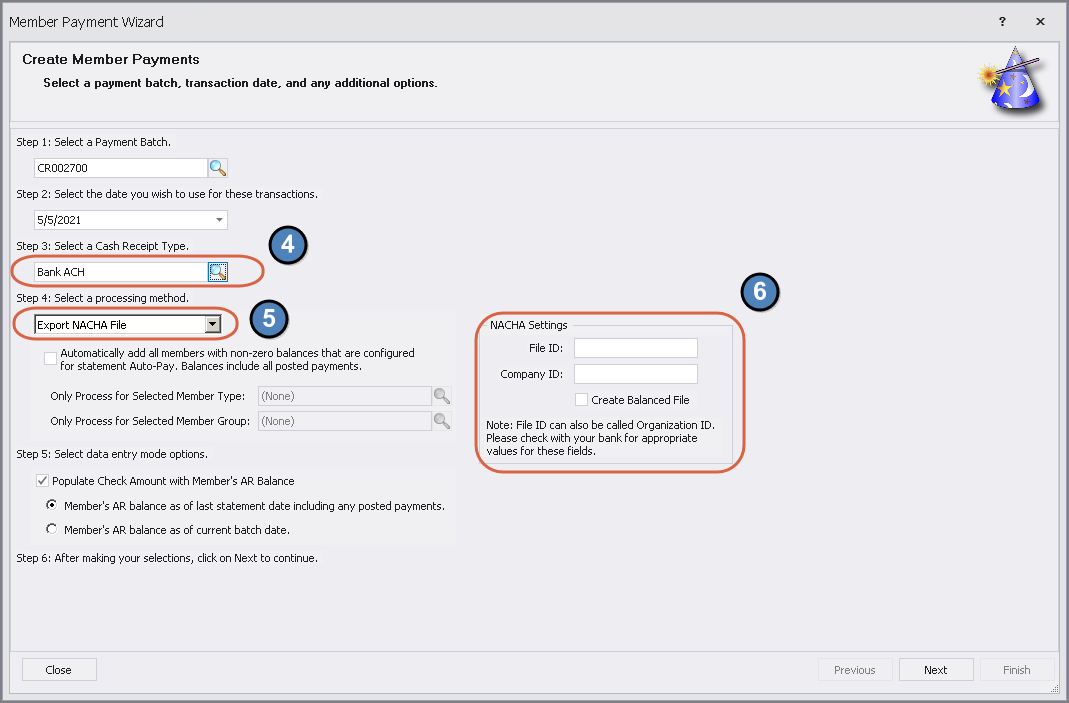

Complete the Payment Wizard as normal, with the following highlighted exceptions.

4. Ensure Bank ACH is chosen

5. Export NACHA File has been selected. Once Export NACHA File has been selected, the NACHA Settings box will open.

6. Contact your bank to receive the proper information to populate the NACHA settings fields. These will be unique to your bank.

Please Note: If you bank requests a Balanced file click the Create Balanced File checkbox within these settings.

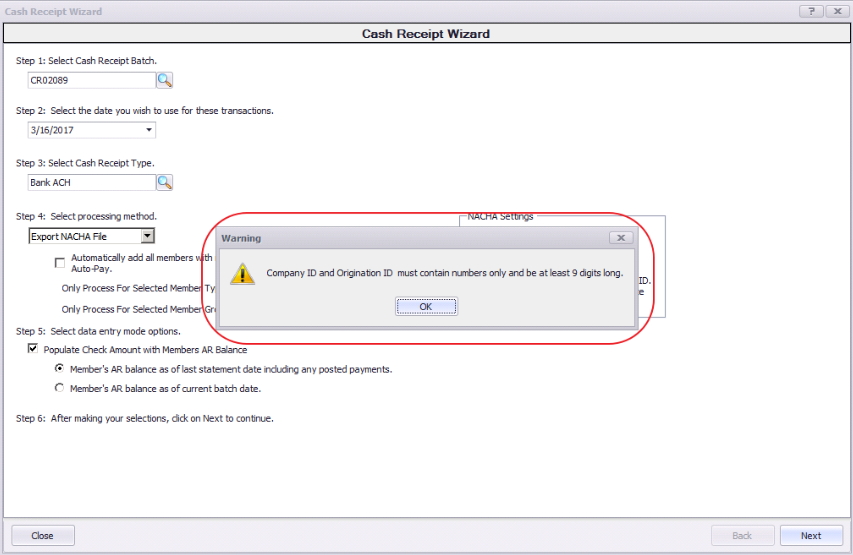

If NACHA Settings are not populated, error message will appear, and you will not be allowed to proceed.

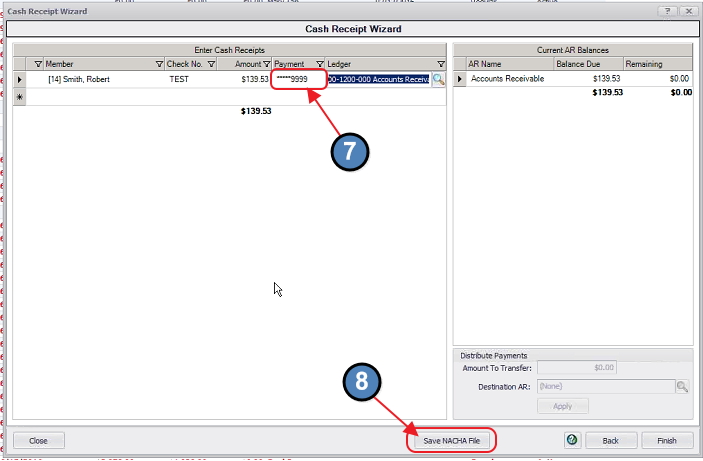

Once populated, proceed to next screen. When populating information in this screen, ensure to select the Member’s account that is to be utilized for ACH payments (previously set up in Member’s profile) in the Payment field (7).

8. Once complete, click Save NACHA File.

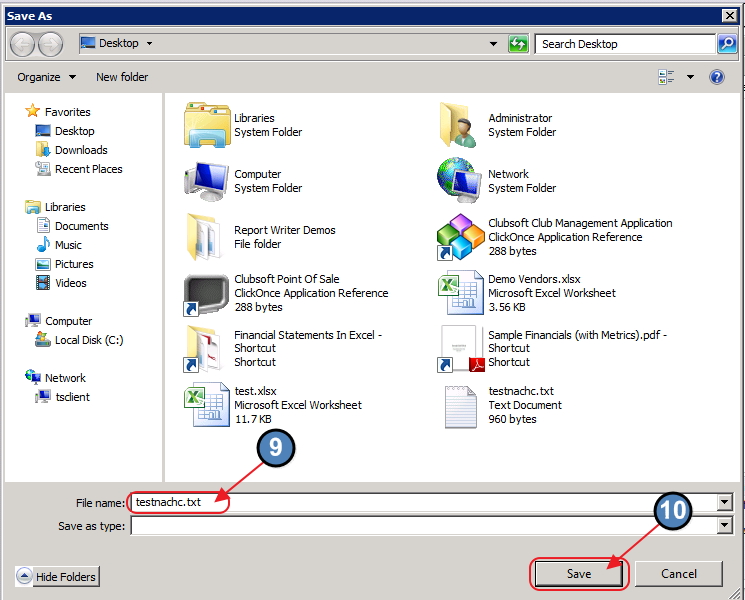

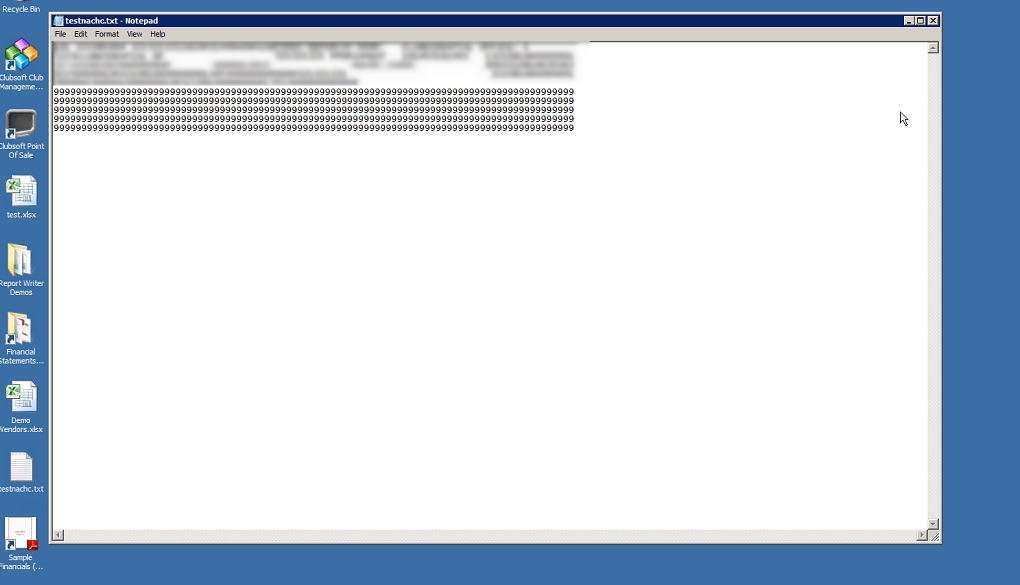

9. Name the NACHA file (end name with .txt)

10. Save file to location of your choice.

The NACHA file is now available for uploading to the Bank.

Complete wizard and posting as normal.

When reviewing General Ledger History, note that ACH file shows successful file generation.

Upload ACH File to Primary Bank

Once complete with the Office steps above, follow your Bank’s instructions to upload NACHA file to your Club Bank’s website.

Switching from Integrated ACH Processor to NACHA Payments

Please contact Office support if the club is switching from a currently integrated third party ACH processor to NACHA payments.

Best Practices

Ensure set up of Member Bank Account and Club G/L Cash Account are proper to reduce/eliminate processing delays.

FAQs

Q. What are the major benefits of taking ACH payments?

A. It is a very low-cost solution that allows Members the ease of making electronic payments, and Clubs the ease of accepting electronic payments. It also gives Clubs the power to work with the Bank of their choice directly without the need for an intermediary processor.